A Beginner’s Guide to Cryptocurrency Trading Strategies

There are many ways to make money trading cryptocurrencies. A trading strategy helps to organize the relevant techniques into a coherent framework that you can follow. This way, you can continuously monitor and optimize your crypto trading strategy.

When developing a trading strategy, there are two main schools of thought to consider: technical analysis (TA) and fundamental analysis (FA). We will distinguish between trading scenarios that different strategies are suitable for, but before we dive into this article, it is important to understand the differences between these concepts.

There are so many different types of trading strategies that it is difficult to cover them all in detail, so we will focus on the most common ones. This article focuses on trading strategies for cryptocurrencies. However, such strategies can also be applied to other financial assets such as forex, stocks, options or precious metals such as gold.

Want to tailor a trading strategy for yourself? This article will sort out the basics of speculating in the crypto market. With a solid trading strategy, you will be more likely to achieve your trading and investment goals.

What is a trading strategy?

We define a trading strategy as a comprehensive plan that covers all trading activities. This framework created by the trader guides all of his or her trades.

Additionally, a well-thought-out trading plan can help reduce financial risk by eliminating many unnecessary decisions. While having a trading strategy is not a necessary part of trading, it can sometimes save your assets and prevent financial losses. If the current (and future) market conditions are unexpected, a trading plan will guide traders to take appropriate actions according to different situations and avoid being overwhelmed by personal emotions. In other words, having a trading plan can prepare for the rainy day and have a foolproof plan for possible outcomes. It can prevent traders from making hasty decisions that may result in huge losses due to impulse.

For example, a comprehensive trading strategy may include the following:

1、Asset classes to trade

2、Setups to implement

3、Tools and indicators to use

4、Trigger prices for buying and selling (setting stop-loss points)

5、Determinants of position size

6、Ways to record and measure portfolio performance

Trading plans can also include other basic rules, even some details that are easy to overlook. For example, traders can set a rule not to trade on Fridays, or avoid completing trades when they are too tired to think rationally. They can even create a trading schedule to trade only on certain days of the week. Do you keep an eye on the price of Bitcoin over the weekend? You can choose to always close your positions before the weekend. This customization can be set up in a trading strategy.

Developing a trading strategy can also include validation through backtesting and forward testing.

In this article, we focus on two types of trading strategies: active trading and passive trading.

You will soon realize that the definition of a trading strategy is not very strict and there can be overlap between different strategies. In fact, a hybrid approach that combines multiple strategies is a wise investment solution.

Active Trading Strategies

Active trading strategies require more time and effort. They are called “active” because they require constant monitoring of market dynamics and frequent portfolio management.

Day Trading

Day trading is probably the most well-known active trading strategy. It is a common misconception that all active traders are necessarily day traders.

Day trading involves buying and selling within the same day.

Therefore, the goal of a day trader is to profit from intraday price movements (i.e. price changes within a single trading day).

The term “day trading” comes from traditional markets where trading activities are only available during certain hours of the day. Therefore, day traders in traditional markets never hold positions overnight, so trading is suspended during this time.

In contrast, most cryptocurrency trading platforms are open 24/7. Therefore, in the cryptocurrency market, day trading strategies are used in a slightly different context and usually refer to a short-term trading style where traders buy and sell within 24 hours or less.

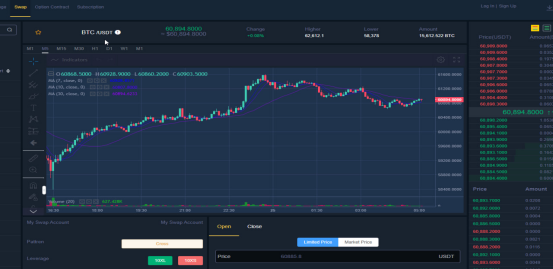

Day traders often use price action and technical analysis to build trading ideas. In addition, they may use a variety of other techniques to find market inefficiencies.

Day trading in cryptocurrency can significantly increase returns for some people, but it is often very stressful, demanding, and can involve extremely high risk. Therefore, day trading is more suitable for experienced and advanced traders.

Swing Trading

Swing trading is a long-term trading strategy, meaning that positions are held for more than one day, but usually not more than a few weeks or a month. In some ways, swing trading is between day trading and trend trading.

Swing traders often actively exploit swings in volatility, which take days or weeks to show results. Swing traders may combine technical and fundamental analysis in the process of building trading ideas. Fundamental changes usually take a long time to manifest, which is where fundamental analysis comes in. Even so, chart patterns and technical indicators can still play an important role in a swing trading strategy.

Swing trading is probably the most convenient active trading strategy for beginners. Compared with day trading, swing trading has a significant advantage in that it takes a long time to show results. But this process is not so long that it makes it difficult to track swing trades.

This gives traders more time to think about whether their decisions are wise. In most cases, they have ample time to respond to changes in trading. In swing trading, decisions do not have to be rushed and can be more rational. Day trading usually requires investors to make decisive decisions and execute quickly, which may be difficult for beginners to adapt to.

Trend Trading

Trend trading is sometimes called “position trading”. This strategy is aimed at holding positions for a long period of time, usually not less than a few months. As the name suggests, trend traders try to take advantage of directional trends to gain benefits. Trend traders may buy long positions in an uptrend and short positions in a downtrend.

Trend traders often use fundamental analysis, but not always. Even so, fundamental analysis takes into account events that may take a long time to play out, and this is exactly the change that trend traders try to take advantage of.

Trend trading strategies assume that the underlying asset will continue to move in the direction of the trend. However, trend traders must be alert to the possibility of a trend reversal.

Therefore, they can also incorporate moving averages, trend lines, and other technical indicators into their trading strategies in an effort to increase their trading success rate and mitigate financial risk.

Trend trading is also ideal for beginners who can properly perform due diligence and risk management.

Scalping

Scalping, commonly known as “scalping,” is one of the fastest trading strategies available. Scalping does not take advantage of large changes or long-lasting trends. The strategy focuses on repeatedly taking advantage of small changes in the market. For example, profiting from the bid-ask spread, liquidity gaps, or other inefficiencies in the market.

The core idea of scalping is to avoid holding positions for long periods of time. It is not uncommon for scalpers to enter and exit positions in just a few seconds. For this reason, scalping is often associated with high-frequency trading (HFT).

Scalping is a very lucrative strategy if a trader finds that market inefficiencies occur repeatedly and are profitable. Each time an inefficiency occurs, a small profit can be made. These profits accumulate over time and eventually become a substantial return. In liquid markets, where buy and sell transactions are relatively smooth and predictable, scalping can often achieve good returns.

Scalping is an advanced trading strategy that is relatively complex and is not recommended for beginners. This trading strategy also requires a deep understanding of market mechanics. In addition, scalping is more suitable for large traders (whales). Since the target profit margin is usually smaller, trading large positions is more valuable.

Want to try digital currency trading? Please register an account with Bingat and we will teach you how to buy Bitcoin.

Passive investment strategies

Passive investment strategies reduce the difficulty factor and significantly reduce the time and energy involved in managing a portfolio. Although there are differences between trading strategies and investment strategies, the ultimate goal of trading is to earn a profit by buying and selling assets.

Buy and Hold

Buy and Hold is a passive investment strategy where traders buy assets that they plan to hold for the long term, regardless of market fluctuations.

This strategy is often used for long-term portfolios and involves entering the market without considering timing. The core idea of this strategy is that as long as the investment cycle is long enough, the timing or price of entering the market does not matter.

Buy and Hold strategies almost always use fundamental analysis and generally do not focus on technical indicators. When implementing this strategy, you do not need to monitor the performance of your portfolio frequently, just occasionally.

Although Bitcoin and digital currencies have only been around for more than a decade, the “HODL” imagination it has created is very comparable to the “buy and hold” strategy. However, digital currency is a very risky and volatile asset class. Although buying and holding Bitcoin is a well-known strategy in the digital currency field, this strategy may not be applicable to other digital currencies.

Index investment

Index investing usually means buying ETFs and index funds in traditional markets. However, such products exist in the cryptocurrency market as well, both on centralized cryptocurrency exchanges and in decentralized finance (DeFi) trading activities.

The idea behind a cryptocurrency index is to take a portfolio of cryptocurrency assets and create a token that tracks their combined performance. The portfolio can be made up of tokens from similar sectors, such as privacy coins or utility tokens. Or, it can be made up of other products, as long as the price source is reliable. As you can imagine, most of these tokens rely on blockchain oracles.

How can investors use cryptocurrency indices? For example, instead of choosing a privacy coin, they can invest in a privacy coin index. This way, they are betting on the development of the entire privacy coin space, rather than putting all their risk on a single coin.

Tokenized index investing is likely to gain more and more popularity in the coming years. It provides a more relaxed way to invest in the blockchain industry and the cryptocurrency market.

Conclusion

Designing a digital currency trading strategy that fits your financial goals and reflects your personal style is not an easy task. We have just introduced some of the most commonly used digital currency trading strategies, and hope that you can find some inspiration to find the best solution for you.

In order to determine which strategies work for you and which don’t, you should try each trading strategy and track its returns, but don’t break the rules you set. You can also create a trading log or worksheet to help you comprehensively evaluate the performance of various strategies.

It is worth noting that traders do not have to always follow the same trading strategy. As long as you have sufficient data and trading records, you should be able to flexibly adjust and modify your trading methods. In other words, personal trading strategies should be constantly modified and developed as trading experience continues to accumulate.

Traders can also split their portfolios into different parts and apply different trading strategies to each part, which is also beneficial. In this way, traders can continue to track the performance of each strategy while implementing appropriate risk management.

Comments

Post a Comment