5 Basic Indicators Used in Technical Analysis

Traders use technical indicators to gain further insight into the price behavior of assets. These indicators make it easier to recognize patterns as well as spot buy and sell signals in the current market environment. There are many different types of technical analysis indicators, and they are widely used by day traders, swing traders, and sometimes even long-term investors. Some professional analysts and advanced traders even create their own indicators. In this article, we will briefly introduce some of the most popular technical analysis indicators that are suitable for any trader’s market analysis toolkit.

1、Relative Strength Index (RSI)

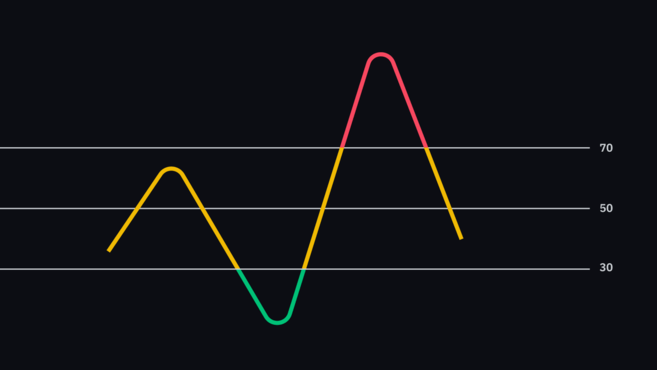

The Relative Strength Index (RSI) is a momentum indicator used to show whether an asset is overbought or oversold. It does this by measuring the magnitude of recent price changes (the standard setting is the previous 14 periods, e.g. 14 days, 14 hours, etc.). This data is then displayed as an oscillator, which can have a value between 0 and 100.

As the RSI is a momentum oscillator, it will show the rate of price change (momentum). This means that if the price is rising while momentum is increasing, then the uptrend is strong and more and more buyers will start to step in. Conversely, if prices are rising while momentum is decreasing, this could indicate that sellers may soon take control of the market.

The traditional interpretation of the RSI is that an asset is overbought when its value exceeds 70, and oversold when its value falls below 30. Therefore, extreme values may indicate an upcoming trend reversal or pullback. Even so, you would be wise not to view these values as direct buy or sell signals. Like many other technical analysis (TA) methods, the RSI can provide false or misleading signals, so it’s always necessary to consider other factors before entering a trade. 2.

2. Moving Averages (MA)

Moving averages smooth out price action by filtering out market noise and highlighting the direction of the trend. It is based on past price data and is therefore a lagging indicator.

The two most commonly used moving averages are the Simple Moving Average (SMA or MA) and the Exponential Moving Average (EMA.) The SMA is plotted by taking price data over a defined period and calculating the average. For example, a 10-day SMA is plotted by calculating the average price over the past 10 days. On the other hand, the EMA is calculated by giving more weight to recent price data. This makes it more responsive to recent price behavior.

As mentioned above, moving averages are lagging indicators, and the larger the time span, the greater the lag. As a result, the 200-day SMA is more slowly responsive to price behavior than the 50-day SMA.

Traders often use price in relation to specific moving averages to gauge the current market trend. For example, if price is above the 200-day SMA for an extended period of time, many traders will assume that the asset is in a bull market.

Traders can also use moving average crossovers as buy or sell signals. For example, if the 100-day SMA crosses down through the 200-day SMA, this may be seen as a sell signal. But what does this crossover really mean? It indicates that the average price of the last 100 days is now lower than the average price of the last 200 days. The idea behind selling at this point is that the short-term price movement is no longer following the uptrend and therefore the trend may be reversing.

3. Exponential Smoothing Moving Average (MACD)

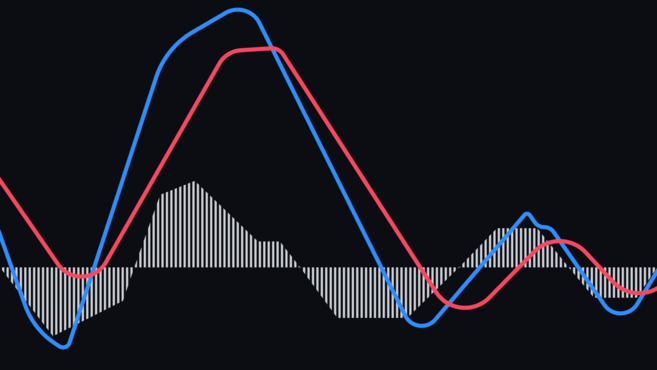

The Exponential Smoothing Moving Average (MACD) determines the momentum of an asset by showing the relationship between two moving averages. It consists of two lines — the MACD line and the signal line. the MACD line is calculated by subtracting the 26-period EMA from the 12-period EMA. the signal line is a 9-period exponential average of the EMA based on the MACD line. Many charting tools will also use histograms to show the difference between the MACD line and the signal line.

By looking at the difference between the MACD and price behavior, traders can gain insight into the strength of the current trend. For example, if price is making higher highs and the MACD indicator is making lower highs, the market may soon reverse. What can the MACD tell us in this case? Price is rising while momentum is falling, so there is a higher likelihood of a pullback or reversal occurring.

Traders can also use this indicator to look at the intersection between the MACD line and the signal line. For example, if the MACD line crosses the signal line upwards, this can be interpreted as a buy signal. Conversely, if the MACD line crosses the signal line downward, it can be interpreted as a sell signal.

The MACD is often used in conjunction with the RSI because both measure momentum but use different factors. It is envisioned that the combination of the two may give a more comprehensive technical outlook on the market.

4. Stochastic Relative Strength Index (StochRSI)

The Stochastic Relative Strength Index (StochRSI) is a momentum oscillator used to indicate whether an asset is overbought or oversold. As the name suggests, it is derived from the RSI, as it is generated from RSI values rather than price data. The indicator is created by applying the so-called “Stochastic Oscillator Formula” to regular RSI values. Typically, the StochRSI has a value between 0 and 1 (or 0 and 100).

Because the StochRSI is faster and more sensitive, it can produce many trading signals that are difficult to interpret. It is also usually most useful when approaching the upper or lower limits of its range.

StochRSI readings above 0.8 are usually considered overbought, while those below 0.2 may be considered oversold. A value of 0 indicates that the RSI was at its lowest value during the measurement period (the default setting is usually 14 periods). Conversely, a value of 1 indicates that the RSI was at its highest value during the measurement period.

Similar to how the RSI is used, an overbought or oversold StochRSI value does not necessarily mean that prices will reverse. In the case of the StochRSI, it simply indicates that the RSI value (the source of the StochRSI value) is near the extreme of its most recent reading. It is also important to remember that the StochRSI indicator is more sensitive than the RSI indicator, so it tends to produce more false or misleading signals.

5. Bollinger Bands (BB)

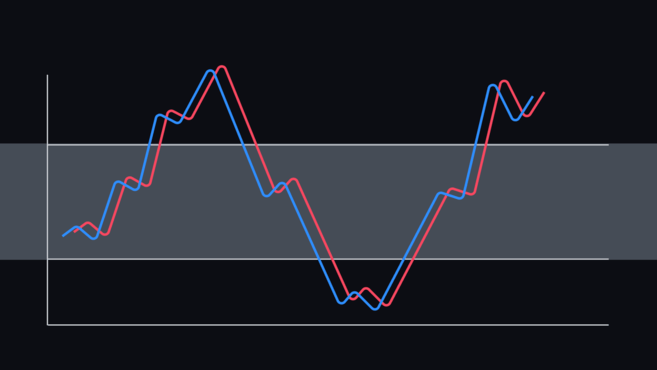

Bollinger Bands (BB) are used to measure market volatility, as well as overbought and oversold assets. It consists of three lines, the SMA (center line) and the upper and lower lines.

Settings may vary, but in general, both the upper and lower rail lines are two standard deviations away from the mid-rail line. As market volatility increases or decreases, the spacing between these lines will expand or contract.

In general, the closer the price gets to the upper rail, the closer the asset on the chart is likely to be to being overbought.

Conversely, the closer the price gets to the lower rail, the closer the charted asset is likely to be oversold. In most cases, price will remain between the rail lines, but in rare cases, price may move above or below the rail lines. This event is not a trading signal per se, but it can serve as an indicator of extreme market conditions.

Another important concept of Bollinger Bands is called the “squeeze indicator”. This refers to the fact that during periods of low volatility, all the bars are very close to each other. It may indicate potential future volatility. On the contrary, if all the bars are far away from each other, there may be a period of declining volatility.

Summarizing

While indicators can show data, one thing you must also consider is that the interpretation of data is very subjective. Therefore, it is always helpful to take a step back and consider whether personal biases are influencing your decision making. What may be an outright buy or sell signal to one trader may just be market noise to another.

As with most market analysis techniques, these indicators only work best when used in conjunction with each other or with other methods such as Fundamental Analysis (FA).

The best way to learn Technical Analysis (TA) is to do a lot of practice.

Comments

Post a Comment