What Risk-Reward Ratio is and how it is used

Should I risk my time to get the information in this article in return?

Risk-return ratio captures the corresponding risk taken to achieve a certain potential reward.

Good traders and investors choose their bets very carefully. They seek investments that have the least potential disadvantage and the greatest potential advantage. If an investment can deliver the same return as another investment, but with less risk, then it may be a better choice.

Are you interested in learning how to calculate your own risk-reward ratio? Read this article to find out.

Whether you choose to day trade or swing trade, there are some basic concepts about risk that you should understand. These will give you some initial insight into the markets and provide you with a basis on which to direct your trading activities and investment decisions. Otherwise, you will not be able to protect the money in your trading account and grow it.

We have already discussed risk management, position adjustments, and setting stop losses. However, there are some crucial elements to understand if you are using an active trading strategy. How much risk is associated with potential rewards? Of your potential strengths versus potential weaknesses? In other words, what is your risk-reward ratio?

We’ll discuss how to calculate the risk-reward ratio for trading in this article.

What is the risk-reward ratio?

Risk-Reward Ratio (expressed as the R/R ratio or R) is able to calculate the corresponding risk that a trader is taking in order to obtain a certain potential return. In other words, it represents the potential return for every dollar you put into an investment.

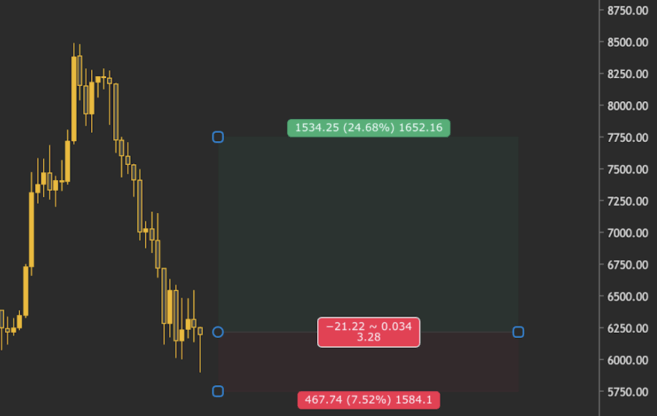

Its calculation itself is quite simple, dividing the maximum risk by the net target profit. How exactly should you do this? First, look at the price level at which you want to start trading. Then, decide where to take profits (if the trade is successful) and where to place a stop loss (if the trade is losing). This is crucial if you wish to manage risk in a proper way. Good traders set profit targets and stop losses before they start trading.

Now that you have determined the target nodes for entry and exit, it is time to calculate the risk-reward ratio. Simply divide the potential risk by the potential reward. The lower the ratio, the greater your potential return per “unit” of risk invested. Let’s see how it works in practice.

How to Calculate Risk-Reward RatioSuppose, you want to open a long position on the Bitcoin platform. You analyze it and determine to take profit at 15% above the entry price. At the same time, you ask the following question. At which price level will your trading idea expire? That is to say where you intend to place your Stop Loss order. In this example, you decide to set the expiration position at 5% below the entry price.

It is important to note that this percentage is usually not optional. You should determine when to take profit and stop loss based on your analysis of the market. Technical analysis indicators can help you do this.

Right now, our take-profit target is 15% and the control point for potential losses is 5%. What is the risk-reward ratio? The calculation is: 5/15 = 1:3 = 0.33. It’s as simple as that. This means that for each unit of risky investment, we have the potential to make three times the return. In other words, the risk we take on each dollar may also be magnified three times. Thus, if we hold a position worth $100, we may make a potential profit of $15 for a loss of $5.

We can reduce this ratio by moving our stop loss closer to the entry price. However, as we said, entry and exit positions should not be calculated based on arbitrary numbers, but on rational analysis. If the portfolio has a high risk-reward ratio, it may not be worth trying to “game” the numbers. It may be better to move on to other setups that have a good risk-reward profile.

Note that positions of different sizes may have the same risk-reward ratio. So, if we hold a position worth $10,000, we are making a potential profit of $1,500 for a loss of $500 (the ratio is still 1:3). The ROI only changes when we change the relative position of the Take Profit target and Stop Loss.

Risk-return ratio

It is worth noting that many traders will perform this calculation in the opposite direction, i.e., calculating the reward-to-risk ratio. Why do this? It’s really just a personal preference. Some people find it better to understand. It calculates exactly the opposite of the risk-reward ratio formula. So, in the above example we have a Risk to Reward ratio of 15/5 = 3. As you might expect, a high Risk to Reward ratio is better than a low Risk to Reward ratio.

Risk and reward analysis

Let’s say we make a bet at the zoo. I will give you 1 bitcoin if you sneak into the aviary and hand-feed a parrot. What is the potential risk of doing that? The risk is that you do something you shouldn’t, and you might get picked up by the police. But if you succeed, you get 1 bitcoin.

In the meantime, I propose an alternative. If you sneak into a tiger cage and feed the tiger raw meat with your bare hands, I will give you 1.1 bitcoins. What are the potential risks of doing this? Well, of course you might still get picked up by the police. But you also run the risk of being attacked by a tiger and fatally injured. On the other hand, it pays off a little bit better than feeding a parrot for a bet. Because if you succeed, you get more bitcoins.

Which one seems like a better deal? Technically, neither of them is a good deal, as you shouldn’t sneak into the zoo. Nonetheless, you’re risking a lot more on the bet to feed the tiger, but the potential reward is just a little bit more.

Similarly, many traders look for combinations of trades where they can gain more than they can afford to lose. This is called asymmetric opportunity (where the potential advantage outweighs the potential disadvantage).

Another thing to mention here is your win rate. Your win rate is the number of profitable trades divided by the number of losing trades. For example, if your win rate is 60%, it means that 60% of your trades will be profitable (here is the average rate). Let’s find out how to apply this ratio in your risk management.

Even so, some traders are able to make high profits with very low win rates. Why is this? Because the risk-reward ratio of their personal trading portfolio is matched. If they only chose a portfolio with a risk-reward ratio of 1:10, they could lose 9 trades in a row and still break even with the remaining one. In this case, they only need to win two out of ten trades to make a profit. This is the power of the Risk vs. Reward calculation.

➟ Want to try out cryptocurrency trading? Sign up for an account at Bingat and we’ll teach you how to buy Bitcoin.

Summarize

We have already covered what risk-return ratio is and how traders can incorporate it into their trading programs. To understand the risk profile of any money management strategy, it is necessary to calculate the risk-return ratio.

Keeping a trading log should also be considered when risk is involved. By keeping a record of trading conditions, you can get a more accurate picture of how your strategy is performing. In addition, you have the flexibility to apply it to different market environments and asset classes.

Comments

Post a Comment